Prime Minister Youth Loan Scheme 2023 - Prime Minister Youth Program Loan Scheme

Prime Minister's Youth Business & Agriculture Loan Scheme (PMYB&ALS)

1. Please refer to IH&SMEFD Circular No. 08 of 2019 dated July 11, 2019 and subsequent instructions issued from time to time regarding Prime Minister's Kamyab Jawan Youth Entrpreneur Scheme (PMKJ-YES).

2. Government of Pakistan has approved revisions in the key features of PMKJ-YES with a view to make it more purposeful and beneficial for small businesses and agriculture. The new components of interest free microloans and agriculture loans have been added in the scheme. Moreover, the scheme has been renamed as Prime Minister's Youth Business & Agriculture Loan Scheme (PMYB&ALS). The key features of PMYB&ALS approved by the Government of Pakistan are reproduced below:

INSTRUCTIONS

Dear Applicant

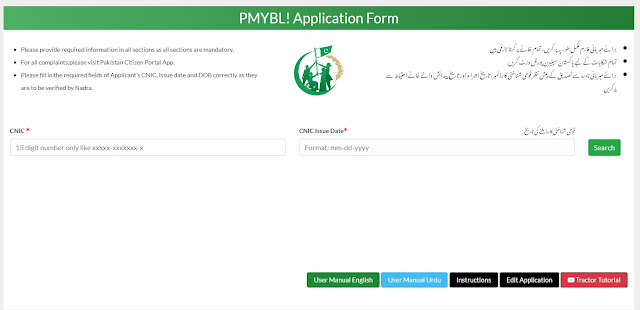

You must have scanned copies / clear visible pictures of following documents ready before you start your application:

1. Passport Size Picture

2. CNIC - Front Side

3. CNIC - Back Side

4. Latest Educational degree / certificate, if and whichever applicable: Matric, Intermediate, Bachelors, Masters, PHD etc.

5. Experience certificate(s), if applicable

6. License / Registration with Chamber or Trade Body, if applicable

7. Recommendation Letter from respective chamber / trade body or Union, this is mandatory in case of existing business.

You must have the following information handy before you start your application:

8. National Tax Number, in case you don’t have one please register at https://fbr.gov.pk/categ/register-income-tax/51147/30846/71148

9. Consumer ID of Electricity bill of your current address. (NITB to link image of where consumer ID is written on electricity bill)

10. Consumer ID of Electricity bill of your current office address, if applicable.

11. Complete Registration number of any vehicle registered in your name, if applicable.

12. Name, CNIC and Mobile numbers of Two References other than Blood relatives.

13. An estimate of Monthly business income, business expenses, household expenses and other income should be available with you in case of new business while in case of existing business please provide actual Monthly business income, business expenses, household expenses and other income, if any details.

Please Note:

a. Please sign up to submit application.

b. You must have a mobile number registered in your name to start this application on which Bank shall communicate with you.

c. This application shall take at least 15 minutes to complete subject to availability of above listed information.

d. You may complete the form in one go or save a draft for submission later on.

e. Please upload as much information as you have e.g. Financial Statements, Business Feasibility, Last 6 months Bank statement, etc. This shall help to better evaluate your application.

f. Once the form is submitted, your application registration number shall appear on the screen and you will also receive SMS stating the same, please keep it safe.

g. You will receive SMS once your application moves to next stage of process, however you may check your submitted application status on this web site as well.

2. U Bank Microfinance Bank (All Branches List)

3. Sindh Microfinance Bank Limited (All Branches List)

4. Finca Microfinance Bank (All Branches List)

5. Khushhali Microfinance Bank (All Branches List)

6. Apna Microfinance Bank (All Branches List)

7. The First Microfinance Bank Limited(All Branches List)

8. Pak Oman Microfinance Bank (All Branches List)

9. Advans Pakistan Microfinance Bank (All Branches List)

10. NRSP Microfinance Bank (All Branches List)

11. Mobilink Microfinance bank (All Branches List)

Shehbaz Sharif

(Prime Minister, Pakistan)

Dear Youngsters! Always remember that you are the biggest asset of Pakistan. Almighty has blessed you with great potential and a lot of qualities.

Positively utilize your strengths and play role in making Pakistan a developed nation. You are the torch bearers of tomorrow. To empower our young population, we have launched several initiatives Under Prime Minister’s Youth Programme.

Be a part of these initiatives, discover your hidden potential, and a bright future is waiting for you.

Shaza Fatima Khawaja

(SAPM on Youth Programme)

Leading the office of Youth Affairs is a great honor. As it enables me to work for the betterment of more than 68 percent population.

Our foremost goal is to facilitate youth in each and every field. PM Laptop Scheme, Loan scheme, Youth Development Center, and National Youth Commission are the initiatives through which we are trying to transform your bright future.

Get involved in our initiatives and play role in making a prosperous Pakistan.

PRIME MINISTER’S YOUTH BUSINESS LOAN

PMYBL promotes entrepreneurship among youth by providing business loans on simple terms and with less markup through 21 Commercial, Islamic and SME banks.

All Pakistani residents, aged between 21 and 45 years with entrepreneurial potential are eligible to apply for the loan. For IT/ E-Commerce related businesses, the lower age limit is 18 years. Applications have to be submitted online only through our website.

Loans provided under PMYBL are segregated into 3 tiers.

Tier 1

The range is 100,000 upto 1 million PKR with 3% markup. No Security required for loan in this tier.

Tier 2

The range is above 1 Million upto 10 Million PKR with 4% markup.

Tier 3

The range is above 10 Million upto 25 Million PKR with 5% markup.

How to apply for Prime Minister Youth Program Loan Scheme

Comments

Post a Comment

Please do not enter any SPAM link in the Comment Box